Transform Your Company Through Public Listing: Unlocking Capital, Credibility, and Growth

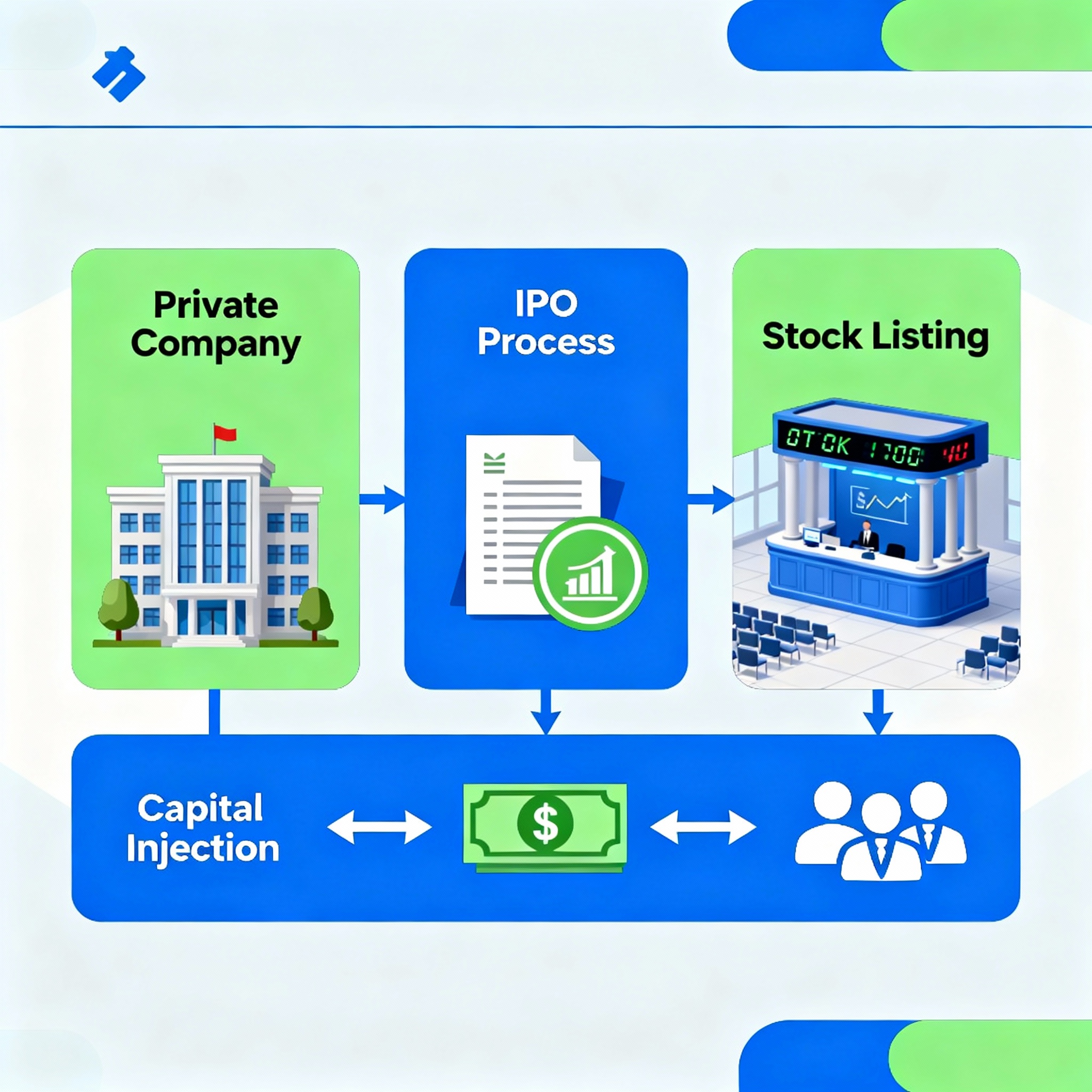

An Initial Public Offering (IPO) represents one of the most transformative moments in a company’s lifecycle. When a private company decides to go public, it doesn’t just sell shares—it fundamentally reshapes its position within the equity capital market, unlocks new growth trajectories, and creates ripple effects throughout the financial ecosystem.

Introduction: The Gateway to Capital Markets

The equity capital market serves as the vital infrastructure connecting companies seeking capital with investors seeking returns. At the heart of this ecosystem lies the IPO process—the mechanism through which privately-held companies transition to publicly-traded entities. This transformation enables companies to raise substantial capital from institutional and retail investors while providing liquidity to early investors and employees.

Understanding IPOs is essential for anyone serious about equity markets. Whether you’re an aspiring investor, a finance professional, or an entrepreneur considering taking your company public, grasping how IPOs function reveals the fundamental architecture of modern capital markets.

Core Insights: The IPO Mechanics

The IPO Process: Companies typically work with investment banks (underwriters) who help determine the offering price, manage regulatory compliance, and distribute shares to investors. The process involves extensive due diligence, SEC registration (Form S-1 in the U.S.), roadshows to attract institutional investors, and finally, the pricing and listing on a stock exchange.

Pricing Mechanisms: Investment banks use various valuation methods including comparable company analysis, discounted cash flow models, and precedent transactions. The final IPO price balances maximizing capital raised with ensuring strong first-day trading performance to satisfy both the company and new investors.

Market Impact: IPOs inject liquidity into the equity capital market, create new investment opportunities, and often signal broader market sentiment. Large IPOs can influence sector valuations and investor appetite for similar companies.

Educational Layer: Key Takeaways

1. Underpricing Phenomenon: Research shows that IPOs are typically underpriced by 10-15% on average, meaning first-day returns often exceed the offering price. This intentional underpricing leaves “money on the table” for investors as an incentive and ensures successful market debut.

2. The Lock-Up Period: Insiders and early investors typically face a 90-180 day lock-up period preventing them from selling shares. This restriction protects against sudden supply shocks but can create price volatility when lock-ups expire.

3. Valuation Formula – Price-to-Earnings Approach:

IPO Valuation = Projected Annual Earnings × Industry Average P/E Ratio

Example: If a company projects $50M in earnings and the industry P/E is 20x, the estimated valuation would be $1 billion.

Real-World Example: Major IPOs That Shaped Markets

Saudi Aramco (2019): The world’s largest IPO raised $25.6 billion, valuing the company at $1.7 trillion. This offering demonstrated how national champions can leverage public markets while maintaining strategic government control.

Alibaba (2014): Raised $25 billion on the NYSE, becoming the largest U.S. IPO. The offering provided Western investors access to China’s e-commerce boom and established a template for Chinese tech companies accessing global capital.

Snowflake (2020): Debuted at $120 per share (versus $120 IPO price that was already raised from $100-110 range), jumping to $245 on day one. This 111% pop illustrated extreme investor demand for cloud data companies and the potential underpricing that benefits initial buyers.

AI Insight: Predictive IPO Analysis

Advanced AI models now analyze IPO performance predictors by examining factors including:

- Venture capital backing quality and reputation

- Market sentiment and volatility indices (VIX) at offering time

- Company fundamentals: revenue growth, profitability trajectory, competitive moat

- Underwriter prestige and allocation strategies

- Industry tailwinds and comparable company performance

Machine learning algorithms can identify patterns suggesting whether an IPO will outperform or underperform in the first year, though market unpredictability ensures no model achieves perfect accuracy.

Key Terms / Glossary

IPO (Initial Public Offering): The first sale of stock by a private company to the public, transitioning the company to publicly-traded status.

Underwriter: Investment bank that manages the IPO process, assumes risk by purchasing shares from the company, and resells them to investors.

Prospectus: Legal document (SEC Form S-1) detailing company financials, business model, risks, and offering terms; required for all public offerings.

Book Building: Process where underwriters gauge investor demand at various price points to determine the final IPO price.

Greenshoe Option: Over-allotment provision allowing underwriters to sell up to 15% additional shares if demand exceeds expectations, stabilizing the stock price.

Call to Action

Ready to deepen your understanding of equity markets? Explore our IPO simulation sandbox where you can practice evaluating offerings, setting price targets, and building allocation strategies without risking real capital.

Read next: “The Psychology of Market Timing: Why Most Investors Buy High and Sell Low” to understand behavioral factors that influence IPO investment decisions.

Stay ahead of the market. Subscribe to our newsletter for weekly insights on equity capital markets, IPO analysis, and investment strategies.