Executive Summary

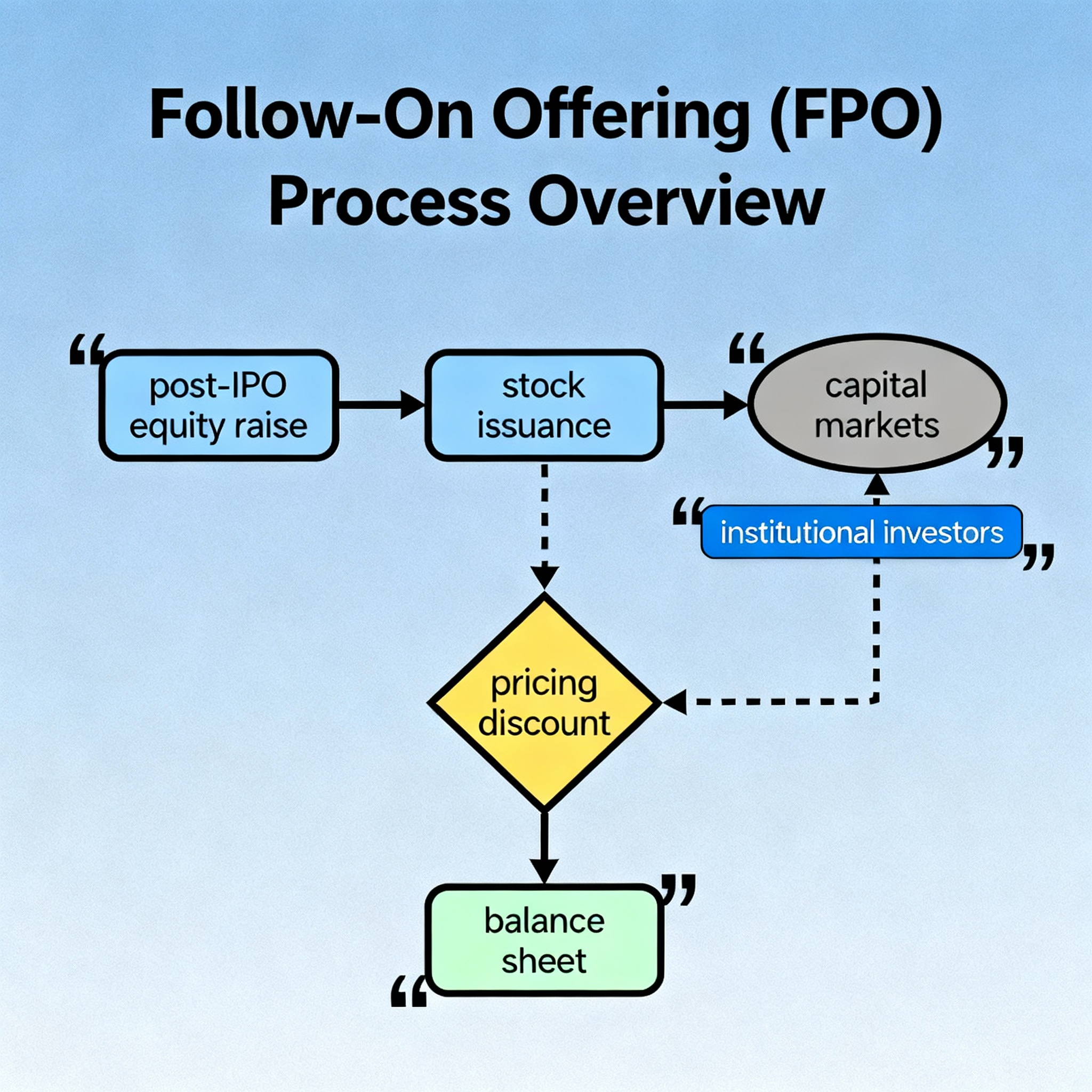

- What it is: A follow-on offering (FPO) issues additional shares after the IPO.

- Why it matters: Funds growth, M&A, or deleveraging while increasing float and liquidity.

- Types: Primary (new shares, dilutive) vs. Secondary (existing holders sell, non-dilutive).

Core Structure

1) Use of Proceeds

- Primary FPOs raise capital for expansion, R&D, capex, acquisitions, or balance sheet repair.

- Secondary offerings provide liquidity for insiders/VCs without raising new company cash.

2) Deal Formats

- Fully marketed: 2–4 day investor education; wider distribution; potential pricing support.

- Accelerated bookbuild (ABB): Overnight/one-day wall-cross; speed reduces market risk.

- Bought deal: Underwriter purchases all shares, assuming market risk for a fee.

3) Pricing Mechanics

- Discount to last close/ VWAP to incentive uptake; typical 2–8% depending on size/volatility.

- Key determinants: Offer size as % of float, recent performance, investor mix, lock-up context.

- Allocation: Tiered between long-only, hedge funds, and existing holders to stabilize post-trade.

4) Dilution and Float

- Primary FPO increases share count; EPS dilution unless proceeds create value above cost of capital.

- Larger public float can tighten spreads, deepen book, and improve index eligibility.

5) Regulatory & Documentation

- Shelf registration (e.g., SEC Form S-3) enables rapid takedowns.

- Prospectus supplements detail use of proceeds, risk factors, and underwriting terms.

6) Execution Timeline

- Pre-soundings and wall-cross → launch → bookbuild → price → allocate → T+1 settlement.

- Stabilization: Greenshoe/over-allotment supports aftermarket performance.

Worked Example

Company XYZ runs an ABB for 15M shares (~7% float) at 4% discount to last close.

- Proceeds: $450M to repay revolver and fund AI capex.

- Impact: EPS -2% near-term; leverage drops from 2.4x to 1.6x; liquidity improves.

Investor Checklist

- Evaluate dilution vs. ROIC on proceeds deployment.

- Scrutinize discount vs. historical norms and deal size.

- Assess lock-ups, insider participation, and underwriter quality.

- Model pro forma ownership, leverage, and EPS.

Glossary

- ABB: Rapid bookbuild to price overnight/next-day.

- Greenshoe: Option to sell 15% extra shares for stabilization.

- Shelf: Registration enabling quick securities issuance.

SEO Keywords

follow-on offering, FPO, secondary offering, accelerated bookbuild, greenshoe, shelf registration, dilution, float, pricing discount, use of proceeds