Follow-On Offerings (FPOs): Raising Additional Equity After the IPO

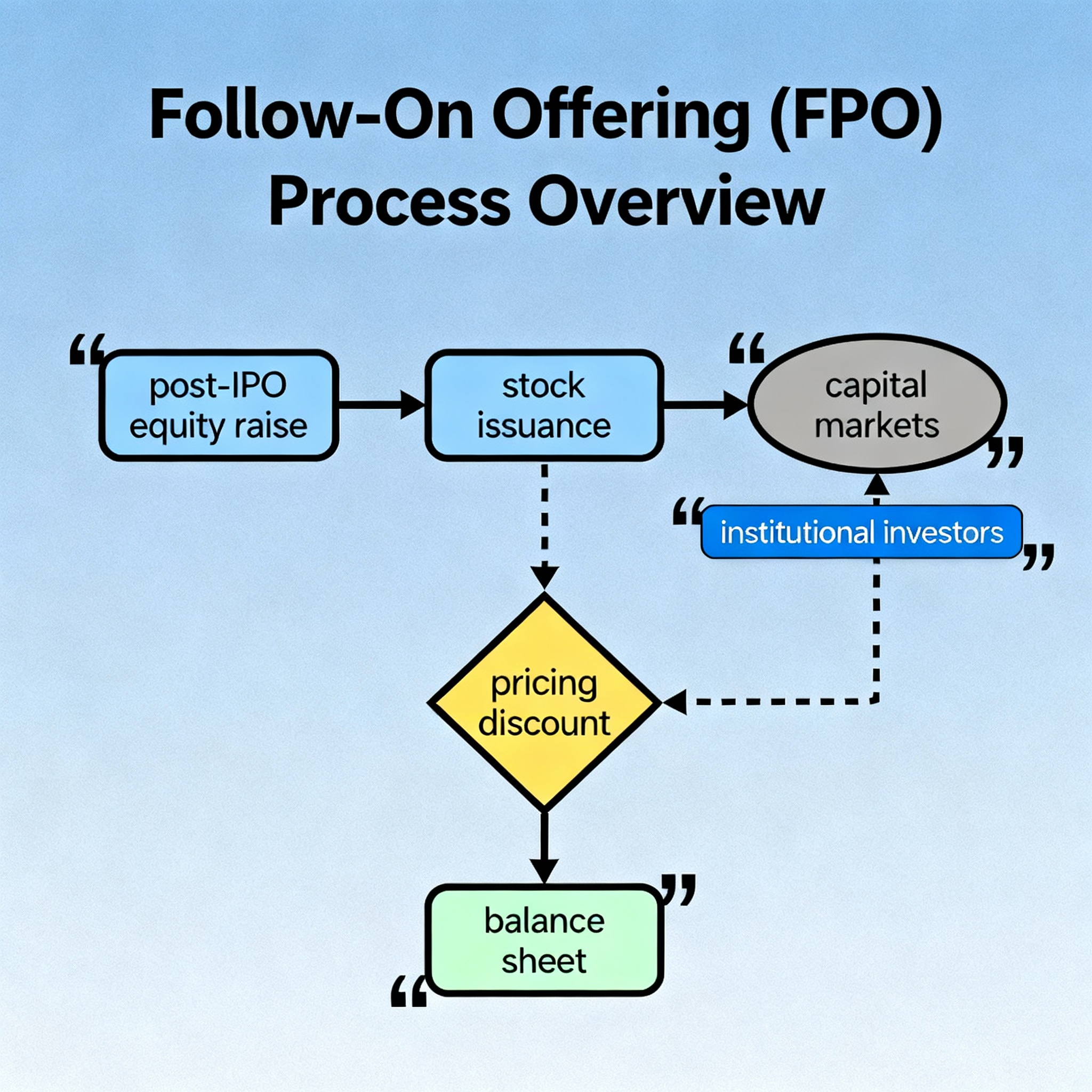

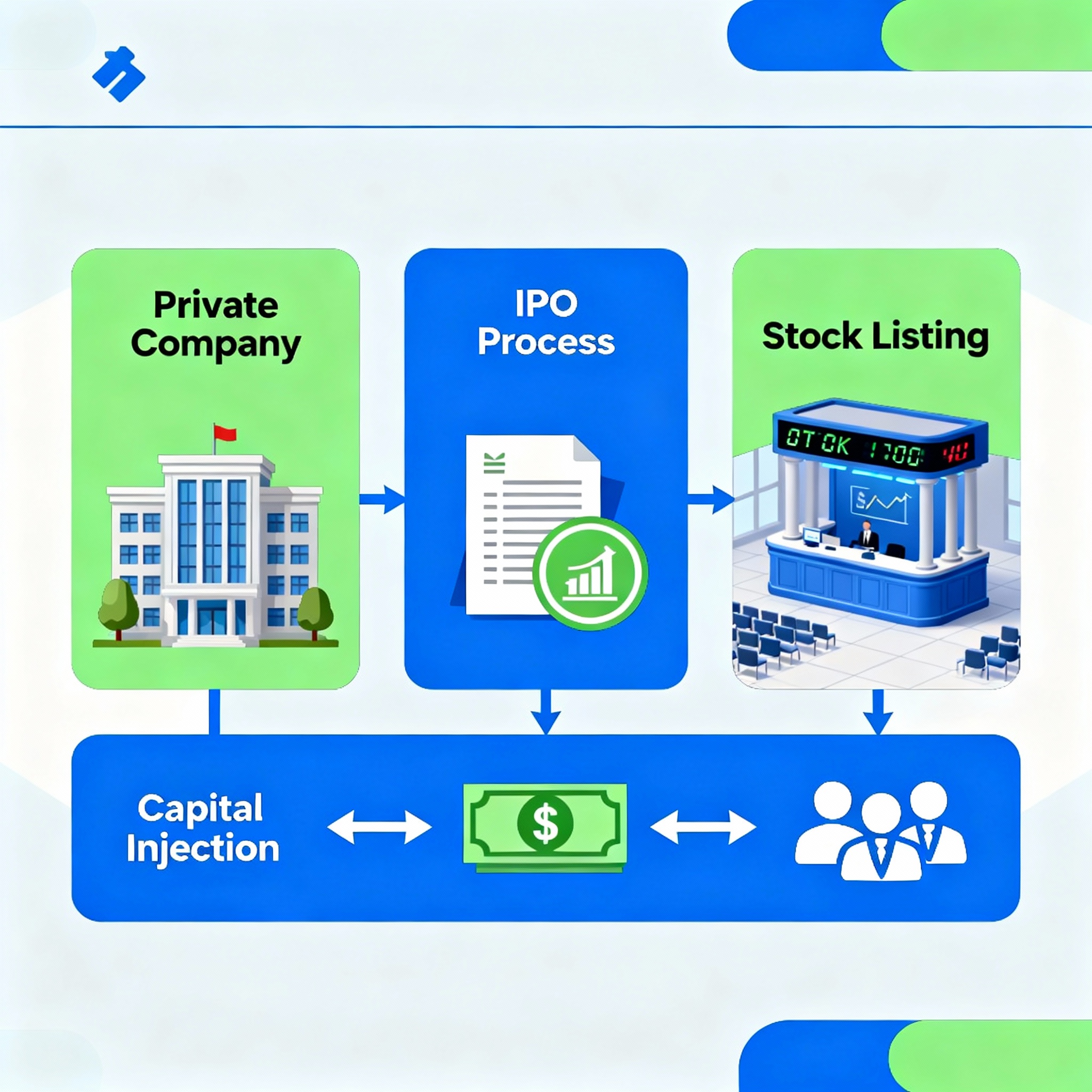

Executive Summary Core Structure1) Use of Proceeds 2) Deal Formats 3) Pricing Mechanics 4) Dilution and Float 5) Regulatory & Documentation 6) Execution Timeline Worked ExampleCompany XYZ runs an ABB for 15M shares (~7% float) at 4% discount to last close. Investor Checklist Glossary SEO Keywordsfollow-on offering, FPO, secondary offering, accelerated bookbuild, greenshoe, shelf registration, … Read more