How Speed, Intelligence, and Technology Are Reshaping Modern Markets

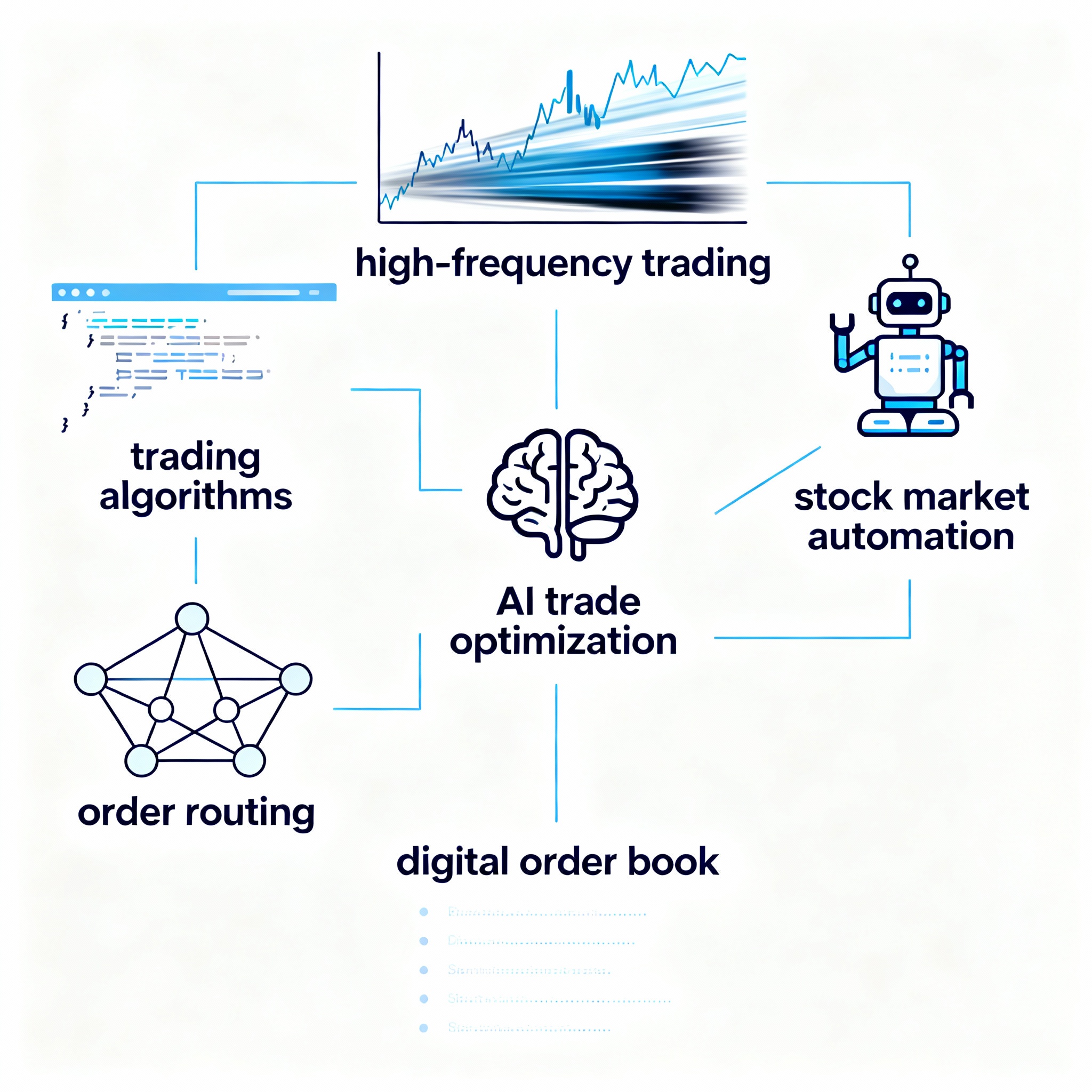

Trading algorithms have revolutionized financial markets, transforming the landscape from human-dominated trading floors to lightning-fast electronic execution environments where billions of orders are processed in microseconds. These sophisticated computer programs analyze market data, identify trading opportunities, and execute orders with minimal human intervention, operating at speeds impossible for manual traders. High-frequency trading (HFT) firms deploy cutting-edge algorithms that capitalize on minute price discrepancies, while AI-driven systems continuously learn from market patterns to optimize order routing and minimize trading costs. Understanding modern algorithmic trading—from the mechanics of HFT strategies to AI-powered order execution—is essential for anyone seeking to comprehend how contemporary financial markets actually operate.

The Mechanics of Algorithmic Trading

Algorithmic trading refers to the use of computer programs to execute trading strategies automatically based on predefined rules and market conditions. At its core, a trading algorithm continuously monitors market data feeds—price quotes, order book depth, trade volumes, news feeds—and applies mathematical models to identify trading opportunities. When conditions match the algorithm’s criteria, it automatically generates and submits orders to exchanges, often splitting large orders into smaller pieces to minimize market impact. The sophistication ranges from simple rule-based systems (“buy when the 50-day moving average crosses above the 200-day”) to complex machine learning models that adapt to changing market regimes in real-time.

High-Frequency Trading Strategies

High-frequency trading represents the most technologically advanced subset of algorithmic trading, characterized by extremely high speeds, short holding periods (often measured in seconds or milliseconds), and massive order volumes. HFT firms invest heavily in ultra-low-latency infrastructure—co-locating servers next to exchange data centers, using specialized network hardware, and optimizing code to the nanosecond level. The goal is to be faster than competitors, gaining first access to market information and trading opportunities.

Key HFT strategies include:

Market Making: HFT firms continuously post bid and ask quotes, profiting from the bid-ask spread while providing liquidity. Their algorithms dynamically adjust quotes based on inventory positions and market volatility.

Latency Arbitrage: Exploiting speed advantages to trade on price information before slower participants can react. For example, if a price change occurs on one exchange, HFT algorithms can trade on other exchanges before those prices adjust.

Statistical Arbitrage: Identifying short-term pricing inefficiencies between correlated instruments and executing simultaneous buy/sell orders to capture the spread.

Liquidity Detection: Using algorithms to detect large hidden orders in dark pools or fragmented across venues, then trading ahead of anticipated price movements.

AI-Driven Order Routing and Execution

Modern trading isn’t just about speed—it’s about intelligence. AI-driven order routing systems use machine learning to determine the optimal way to execute large orders while minimizing market impact and transaction costs. These systems analyze historical execution data, current market conditions, and real-time liquidity across multiple venues to make split-second routing decisions.

Key AI optimization techniques include:

Venue Selection: Algorithms learn which trading venues offer the best execution quality for different order types and market conditions, dynamically routing orders to exchanges, dark pools, or alternative trading systems.

Order Slicing: AI models determine optimal order size and timing to minimize market impact, breaking large orders into smaller child orders executed over time.

Price Prediction: Machine learning models forecast short-term price movements to optimize entry and exit timing, improving execution prices.

Reinforcement Learning: Advanced algorithms learn from past execution outcomes, continuously improving their strategies through trial and error in simulated and live environments.

Key Formulas and Metrics

Implementation Shortfall:

Implementation Shortfall = (Execution Price – Decision Price) × Shares Traded

This measures the cost of execution delay and market impact, representing the difference between the ideal execution price and the actual achieved price.

Volume-Weighted Average Price (VWAP):

VWAP = Σ(Price × Volume) / Σ(Volume)

Algorithms often aim to execute orders at prices better than the VWAP benchmark, which represents the average price weighted by trading volume over a specific time period.

Sharpe Ratio for Algorithmic Strategies:

Sharpe Ratio = (Rstrategy – Rrf) / σstrategy

Where Rstrategy is the strategy return, Rrf is the risk-free rate, and σstrategy is the standard deviation of strategy returns. Higher Sharpe ratios indicate better risk-adjusted performance.

Real-World Examples: Citadel and Renaissance Technologies

Citadel Securities operates one of the world’s most sophisticated algorithmic trading operations, executing approximately 47% of all U.S. retail equity volume. The firm’s technology infrastructure processes millions of quotes per second, using machine learning algorithms to optimize execution across fragmented markets. Citadel’s algorithms dynamically adjust to market conditions, providing liquidity while managing inventory risk through sophisticated hedging strategies. Their order routing intelligence determines optimal execution venues in real-time, minimizing costs for retail order flow they handle.

Renaissance Technologies, founded by mathematician James Simons, pioneered quantitative algorithmic trading with their flagship Medallion Fund, which has delivered extraordinary returns (averaging 66% annual returns before fees from 1988-2018). Renaissance employs hundreds of PhDs in mathematics, physics, and computer science who develop proprietary algorithms based on statistical patterns discovered through massive data analysis. Their models identify subtle correlations and market inefficiencies invisible to human traders, executing thousands of automated trades daily across global markets. The firm’s success demonstrates the power of combining advanced mathematics, big data analytics, and algorithmic execution.

Dark Pools and Order Flow Internalization

Dark pools are private trading venues where large institutional orders can be executed away from public exchanges, preventing information leakage that could move prices against the trader. Algorithmic trading systems routinely access dark pools as part of smart order routing strategies, seeking hidden liquidity that won’t impact public market prices. However, the opacity of dark pools has raised concerns about fairness—sophisticated algorithms can detect patterns in dark pool activity and potentially trade ahead of large orders.

Order flow internalization occurs when broker-dealers execute client orders against their own inventory or match them with other client orders rather than sending them to public exchanges. Algorithmic systems manage this process, determining when internalization provides better execution than external routing. Critics argue this creates conflicts of interest, while proponents claim it often results in price improvement for retail investors.

Regulatory Considerations and Market Impact

The rise of algorithmic and high-frequency trading has prompted regulatory scrutiny. The 2010 Flash Crash—when the Dow Jones Industrial Average plunged nearly 1,000 points in minutes before rapidly recovering—highlighted risks of algorithmic trading gone awry. Regulators have implemented circuit breakers, minimum quote durations, and enhanced monitoring to detect manipulative algorithmic strategies like spoofing (placing fake orders to manipulate prices) and layering.

The SEC’s Regulation NMS governs order routing and best execution requirements, while MiFID II in Europe mandates algorithm testing and kill switches. Exchanges implement co-location policies and maker-taker fee structures that influence algorithmic behavior. Understanding this regulatory framework is crucial for developing compliant trading algorithms.

Glossary

Trading Algorithm: A computer program that automatically executes trading strategies based on predefined rules, market data, and mathematical models, minimizing human intervention in the trading process.

High-Frequency Trading (HFT): A type of algorithmic trading characterized by extremely high speeds, short holding periods, and large order volumes, typically seeking to profit from small price discrepancies across markets.

Order Routing: The process of determining which trading venue (exchange, dark pool, or alternative system) will provide the best execution for a particular order, often optimized using AI and machine learning.

Latency Arbitrage: A trading strategy that exploits speed advantages to profit from temporary price discrepancies between markets before slower participants can react to new information.

Dark Pool: A private trading venue where institutional investors can execute large orders anonymously, away from public exchanges, to minimize market impact and information leakage.